2025 has been a watershed year for AI consolidation. Big tech and cloud-native incumbents made aggressive moves to own hardware, experimentation tooling, and the data pipelines that power modern models. The headline deals so far: OpenAI’s merger with Jony Ive’s io Products (May 2025), OpenAI’s acquisition of Statsig (Sep 2, 2025), Meta’s purchase of a 49% stake in Scale AI (June 2025), and Salesforce’s acquisition of Informatica (May 2025). These transactions—ranging from strategic minority stakes to billion-dollar buyouts—show a consistent pattern: companies are buying capabilities that reduce time-to-market for AI products, secure critical training data and labeling infrastructure, and control the data layer across enterprise stacks.

1 — Why 2025’s AI M&A Matters

If 2023–2024 were the years of model breakthroughs and headline-grabbing funding rounds, 2025 is shaping up as the year of integration. After years of rapid model innovation, the focus shifted naturally toward three execution problems: shipping productized AI experiences at consumer scale, reliably training & fine-tuning models with large labeled datasets, and operationalizing AI across enterprises (data governance, feature rollout, A/B experimentation). The largest deals of 2025 address exactly these frictions—hardware & UX, experimentation infrastructure, labeled-data pipelines, and the enterprise data layer—suggesting the industry is moving from “Can we build powerful models?” to “How do we run them safely, quickly, and profitably in the real world?”

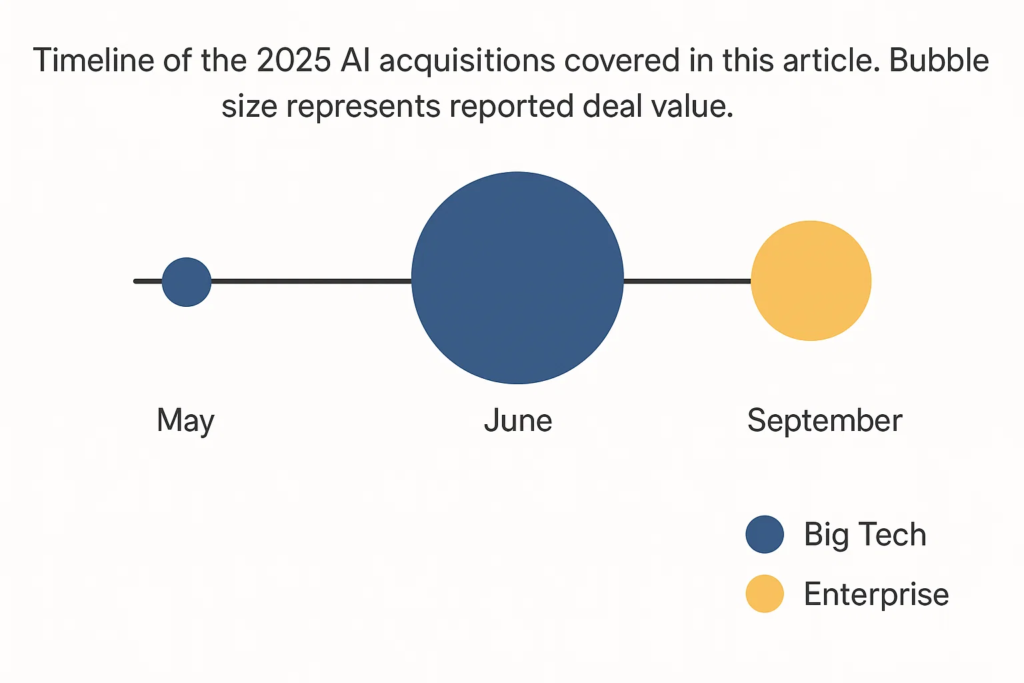

2 — Snapshot: The Big Deals (at a glance)

- OpenAI + io (io Products, Jony Ive) — merger announced May 21, 2025; positioned as a strategic move into AI-first hardware and industrial design.

- OpenAI → Statsig — acquisition announced Sep 2, 2025; reported ~$1.1B (all-stock) to bring industry-leading experimentation tooling in-house.

- Meta → Scale AI (49% stake) — deal reported/announced June 2025; reported ~$14.3–14.8B for 49% non-controlling stake, bringing Scale’s labeling capabilities closer to Meta.

- Salesforce → Informatica — definitive agreement signed May 27, 2025; ~ $8B acquisition to own the enterprise data-management layer.

(Visualization idea: bubble chart sized by deal value; timeline along the top of the article showing May → June → Sep placements.)

3 — Deep Dives: How Each Deal Reshapes the Market

A. OpenAI merges with io Products (May 21, 2025) — Design + hardware become strategic assets

What happened: OpenAI announced that io Products, the design and hardware studio co-founded by Jony Ive and LoveFrom, officially merged with OpenAI in late May 2025. The public “Sam & Jony” message framed the move as a long-term product and experience play. OpenAI positioned the io team to help bring “AI-first” consumer devices and hardware experiences to market.

Why it matters: This is one of 2025’s clearest signals that top AI labs see hardware and industrial design not as afterthoughts but as strategic levers. Owning hardware and design capabilities reduces the friction of delivering tightly integrated experiences (think of how Apple controlled both hardware and software). For OpenAI, having design talent close at hand shortens the path from research to productized, consumer-friendly devices that can host or rely on on-device or edge-accelerated AI. The move also underlines a larger industry trend: AI companies are no longer content to be purely software-first; they want to own the whole stack where necessary.

Immediate market impact: Expect competitors to accelerate partnerships or in-house hardware efforts (custom devices, premium AI assistants, or AI-optimized peripherals). For hardware suppliers and chip partners, it creates new demand signals and negotiation leverage—especially for GPU/accelerator supply agreements and co-engineering efforts. There are also privacy and regulatory angles to watch: hardware that deeply integrates AI capabilities can raise questions around local data processing, telemetry, and cross-border data flows.

Suggested pull-quote: “Design is a product’s first argument for use. Pairing world-class design with frontier models shortens the journey from ‘wow’ to ‘habit.’” — paraphraseable from company statements.

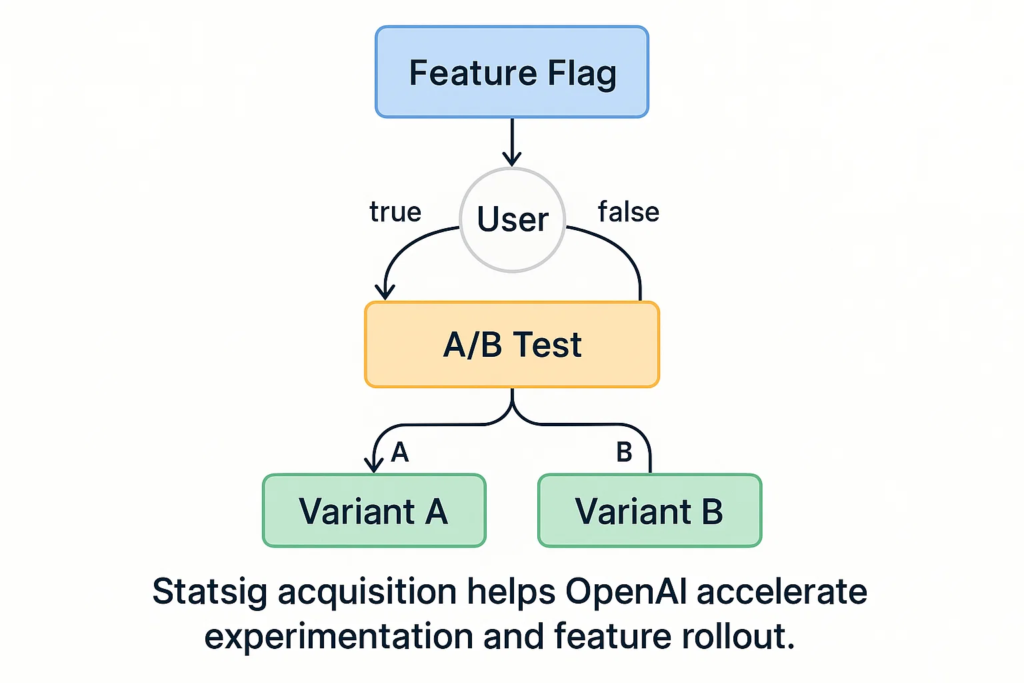

B. OpenAI acquires Statsig (Sep 2, 2025) — Product experimentation as strategic advantage

What happened: On September 2, 2025, Statsig announced it had signed a definitive agreement to join OpenAI in an acquisition reported at about $1.1 billion in an all-stock deal. OpenAI publicly stated the acquisition would bring trusted experimentation tooling—feature flags, A/B testing, real-time decisioning—more deeply into its product development infrastructure.

Why it matters: Iteration speed is a competitive moat. For companies shipping user-facing AI products, being able to run safe, data-driven experiments and roll back changes quickly reduces risk and accelerates product improvement. By bringing Statsig in-house, OpenAI gains tighter control over how features are prototyped, rolled out, and measured across its products (ChatGPT, developer APIs, plugins, and potential hardware devices). This is especially important in AI where subtle changes in prompts, model weights, or safety filters can have outsized product consequences.

Immediate market impact: Expect more emphasis across the industry on product-experimentation tooling for AI: tighter integration between model updates and deployment tooling, more automation in rollout rules based on model outputs, and richer telemetry capturing model drift and failure modes. For startups in MLOps and feature-flagging, this may accelerate consolidation or create new partnership opportunities with cloud providers and model hosts.

Suggested pull-quote: “Acquiring the ability to iterate faster is the modern equivalent of acquiring customers—changes roll out faster, learnings compound.” — paraphrased analyst perspective.

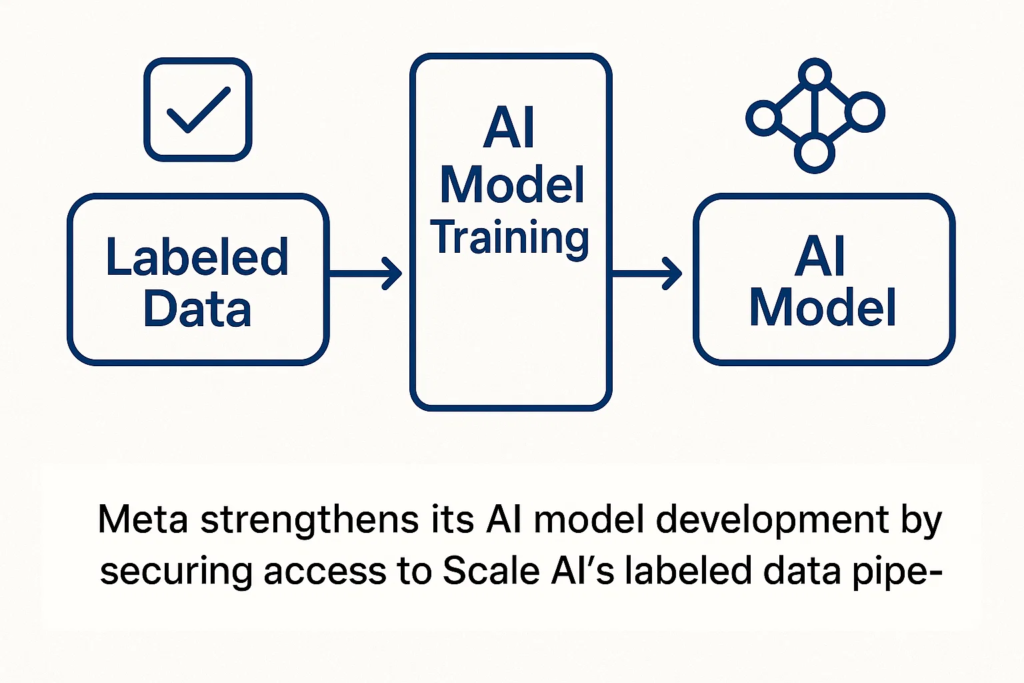

C. Meta takes a 49% stake in Scale AI (June 2025) — Securing labeled data and talent

What happened: In June 2025, multiple outlets reported that Meta would pay roughly $14.3–14.8 billion to acquire a 49% stake in Scale AI, a leading provider of labeled training data and annotation services. The transaction reportedly included arrangements to bring Scale’s CEO Alexandr Wang into a leadership role at Meta, while Scale would continue to operate with some independence.

Why it matters: Labeled data remains the fuel for supervised and semi-supervised ML. By securing a large stake in Scale, Meta not only gains preferential access to a premier data-labeling pipeline but also acquires institutional know-how and talent—critical to improving model quality and closing the gap with competitors. The deal also underlines the strategic nature of data-supply chains: companies increasingly view labeling and data pipelines as core assets, akin to owning a proprietary dataset or model architecture.

Immediate market impact & risks: The investment raises competitive and regulatory eyebrows. Competitors who rely on Scale for labeling may worry about conflicts of interest, and regulators may scrutinize whether such investments harm fair access to infrastructure that many model developers rely on. On the other hand, the deal accelerates Meta’s model development and underlines an industry-wide recognition that data ops—collection, labeling, verification, and lineage—are as strategic as compute.

Suggested pull-quote: “Buying into the data supply chain is buying into the engine of model improvement.” — paraphrase of analyst commentary.

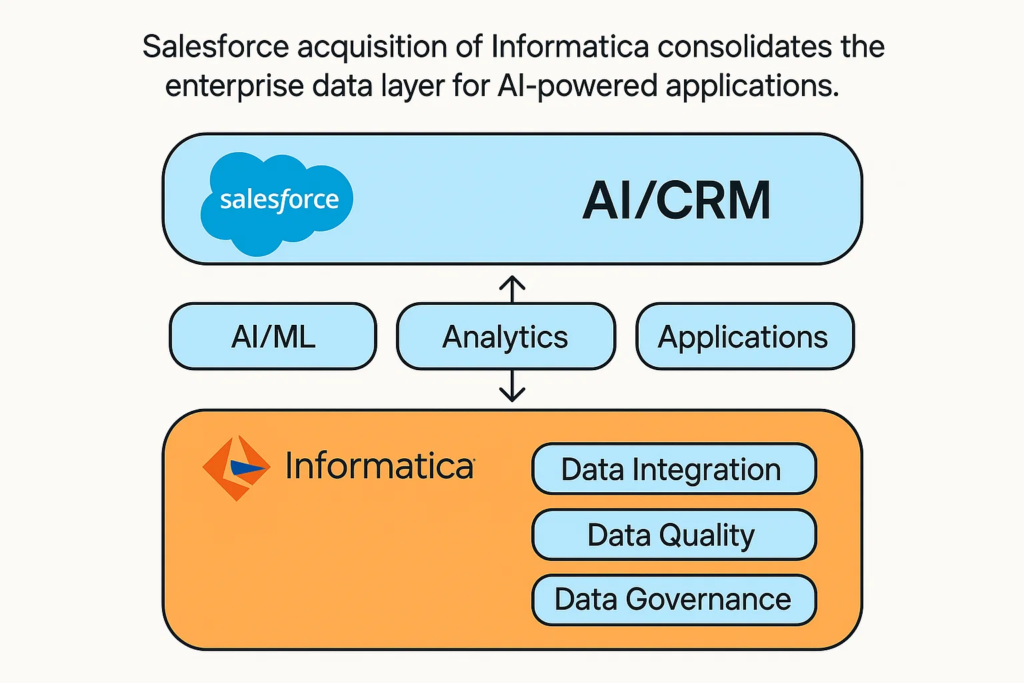

D. Salesforce acquires Informatica (May 27, 2025) — Owning the enterprise data layer

What happened: Salesforce announced a definitive agreement to acquire Informatica for about $8 billion on May 27, 2025. The acquisition was marketed as a strategic move to strengthen Salesforce’s data management and governance capabilities—foundational elements to deliver AI-driven CRM and automation at enterprise scale.

Why it matters: Enterprise AI depends on high-quality, governed data. Informatica’s tools for data integration, cataloging, governance, and quality plug directly into that need. For Salesforce, integrating Informatica’s capabilities promises to shorten customers’ path from raw data to actionable AI-driven workflows inside CRM, marketing, and service products—especially important as enterprises demand auditable, compliant AI features.

Immediate market impact: Expect tighter bundling of AI features with enterprise data products. Competitors in the CRM and data stack will either buy or partner to offer similar end-to-end data-to-AI value propositions. For data engineering teams, the result should be fewer point solutions but more platform consolidation—and increased scrutiny around vendor lock-in and migration costs.

Suggested pull-quote: “Owning the data layer is the shortest route to delivering trusted, auditable AI inside the enterprise.” — paraphrased industry expert.

4 — Cross-Deal Themes: What These Acquisitions Collectively Tell Us

Putting these deals together reveals a few consistent themes shaping AI’s next phase:

1. The stack is re-assembling around outcomes, not just models

Companies aren’t simply acquiring models—they’re buying capabilities that make models useful in production: hardware (io), experimentation (Statsig), labeled data (Scale), and governed data (Informatica). The result is a stack optimized for delivering measurable customer outcomes rather than pushing research milestones alone.

2. Speed of iteration = competitive moat

OpenAI’s Statsig acquisition underscores an obvious but often overlooked truth: the faster you can test, measure, and roll back product changes, the faster you learn and the less risky your launches become. In the realm of AI—where subtle prompt or model changes can materially alter behavior—experimentation tooling is a strategic asset.

3. Data pipeline control is strategic and controversial

Meta’s Scale stake highlights why labeled data and annotation platforms are no longer ancillary—control over these assets can accelerate model training, but also raises competition and privacy questions. Expect regulators to watch these moves closely.

4. Enterprise consolidation is accelerating

Salesforce’s purchase of Informatica is emblematic of enterprise vendors consolidating horizontally to own the entire value chain from raw data to AI-driven business outcomes. This can reduce time-to-value for customers, but also concentrates power and raises vendor-lock-in concerns.

5 — Regulatory & Ethical Watchpoints

A few guardrails and concerns to monitor as these deals unfold:

- Competition & preferential access: When a large platform takes a big stake in a data supplier (e.g., Meta + Scale), rivals may lose neutral access or face slower turnarounds for services. Regulators could interpret this as an abuse of essential infrastructure and respond with structural or behavioral remedies.

- Privacy & cross-use of data: Acquisitions that combine model providers with data pipelines or hardware mean more touchpoints for personal data. Companies must be transparent about data flows and maintain strong governance to avoid cross-product exploitation of user data.

- National security & export controls: Hardware plays and high-end compute arrangements increasingly intersect with export-control regimes and national security policy; deals involving hardware co-design or chip supply may attract government scrutiny.

6 — What Startups Should Watch (6–12 months)

If you’re a founder or product leader in AI tooling, here’s how to interpret these moves and where acquisition interest is likely to focus:

- Experimentation & product ops: If your tech helps teams measure and ship AI features safely, you’re in a hot category. Prioritize enterprise integrations and compliance features.

- Labeling, data quality, & synthetic data tooling: Firms that reduce labeling costs, provide provenance, or enable higher-quality training pipelines will be valuable—especially if you can prove cross-customer privacy-safe workflows.

- On-device & edge AI companies: Hardware-enabled UX (edge models, accelerators, custom silicon partnerships, or AI-native industrial design) will attract strategic acquirers seeking differentiated consumer experiences.

- Data governance & lineage: Tools that make it simple for enterprises to audit datasets, prove consent, and track model inputs/outputs will be indispensable post-Informatica.

Checklist for founders: build enterprise revenue and contracts (recurring ARR), instrument rigorous data governance, demonstrate clear ROI in the face of consolidation, and keep a clean cap table that makes acquirers’ due diligence faster.

7 — Editorial Suggestions: Visuals & Pull-Through Content

Visuals to include:

- Timeline of the 2025 deals (May → Jun → Sep) with bubbles sized by disclosed value.

- Stack diagram for each acquirer showing “Before” vs “After” (e.g., Salesforce + Informatica = integrated data layer feeding Einstein/AI CRM features).

- Short explainer animation (60–90s) summarizing why owning hardware, label pipelines, experimentation, and governance matters.

Data & citation sources (quick): OpenAI press materials (Sam & Jony letter, Statsig join announcement), Reuters coverage on Meta/Scale, Salesforce press release, TechCrunch / GeekWire on Statsig, and analyst blog posts on enterprise M&A.

8 — Ready-to-Use Social Copy & Meta

Meta Title: The Biggest AI Tool Acquisitions of 2025 (So Far) — OpenAI, Meta, Salesforce Moves Explained

Meta Description (155 chars): A data-driven look at 2025’s biggest AI acquisitions—from OpenAI’s hardware and experimentation plays to Meta’s Scale AI stake and Salesforce’s data bet.

Twitter / X (short): 2025’s AI M&A is about control — of hardware, experiments, data, and governance. Here are the biggest deals so far and what they mean. (link)

LinkedIn (longer): This year’s largest AI deals show a common theme: companies are buying the operational levers—experimentation, labeled data, hardware, and data governance—that turn models into reliable products. Read our breakdown of the OpenAI, Meta, and Salesforce moves and what founders should do next. (link)

9 — FAQs

Were the deal values confirmed or reported?

Several figures reported in the press are based on disclosures and reporting; readers should consult the listed primary press releases for final confirmed values. (See OpenAI, Salesforce press releases, Reuters coverage on Meta/Scale, and Statsig announcement.)

Will these deals trigger anti-competitive action?

Meta + Scale was flagged as the most likely to attract regulatory attention due to preferential access to labeled data; regulators globally are increasingly sensitive to concentration of critical AI infrastructure.

What should customers of these acquired companies expect?

In most cases, press releases suggest continued product independence in the near term, but customers should watch contract language about data usage, exclusivity, and service-level changes.